2022 Was Not a Bear Market

2022 Was a Rough Year

2022 may have been a painful year for the economy, and many are wondering whether the Federal Reserve will ease up on interest rate hikes. Currently, we’re seeing the fastest rate increases since the days of former Fed Chair, Paul Volcker, in the 1980s.

Massive Devaluations of Companies

In 2022, we saw median pre-money Series A valuations drop by 50% from $79M to $39M. There was a 74% decline for Series B valuations, an 87% decline for Series C valuations. Median pre-money Series D valuations fell dramatically by 92% from $3.47 billion to $290 million. [Note: This is for companies that had to raise in 2022.]

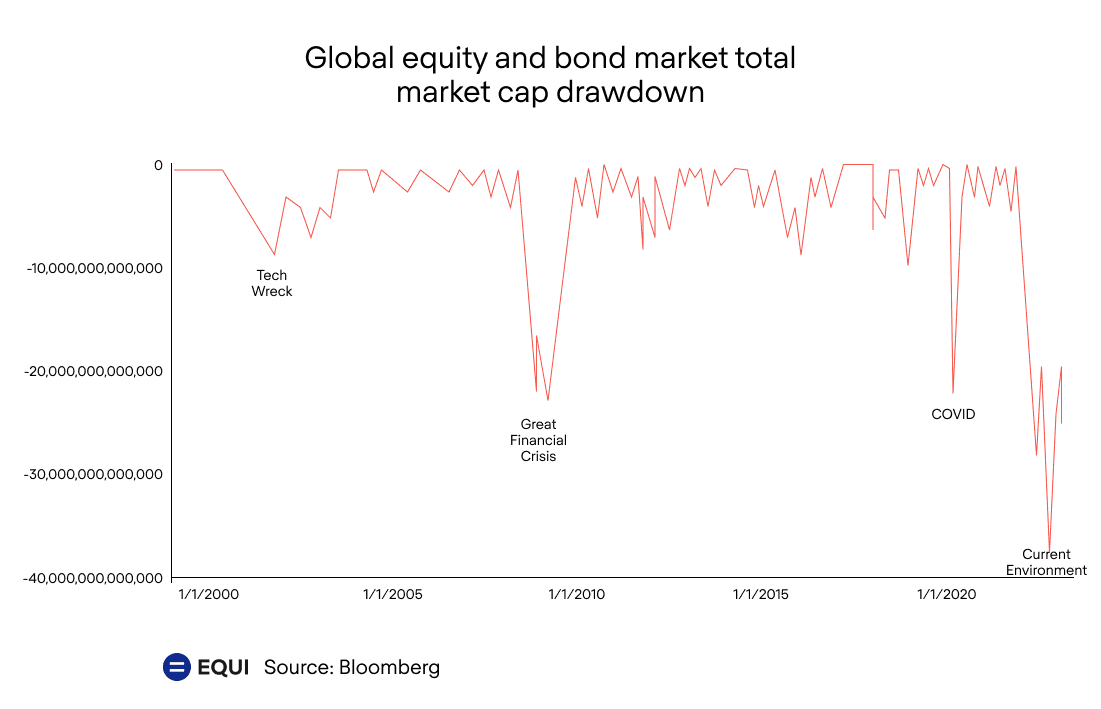

Historic Destruction of Wealth

We are witnessing the largest drawdown and wealth destruction that we have seen in decades.

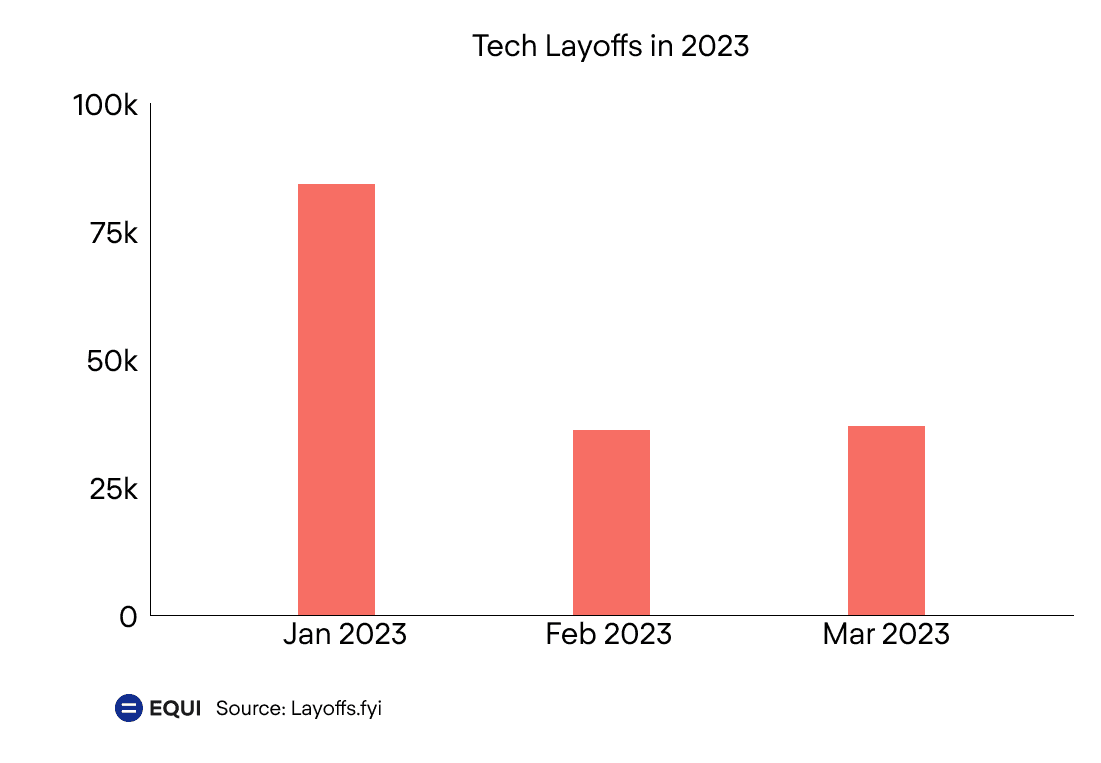

Layoffs and Increasing Unemployment

There were 15.4 million layoffs in the United States in 2022. Many of the companies that led the 10-year bull market rally such as Amazon, Meta, and Google, also led the round of layoffs as they adapted to the new economic environment of rapidly rising interest rates. Announcements of planned layoffs seem to continue into 2023. [See TechCrunch article for more stats.]

Despite the above doom and gloom, we don’t believe 2022 was a bear market.

We believe 2022 was simply a re-rating of the economy.

Why?

2022 Was not a Bear Market

Data Point #1: The Yield Curve

The yield curve usually starts to dis-invert as you enter a bear market. In 2022, the yield curve inverted while stocks fell.

Data Point #2: Bond and Equities Correlation

Rather than moving in opposite directions, bond and equity prices moved in unison in 2022.

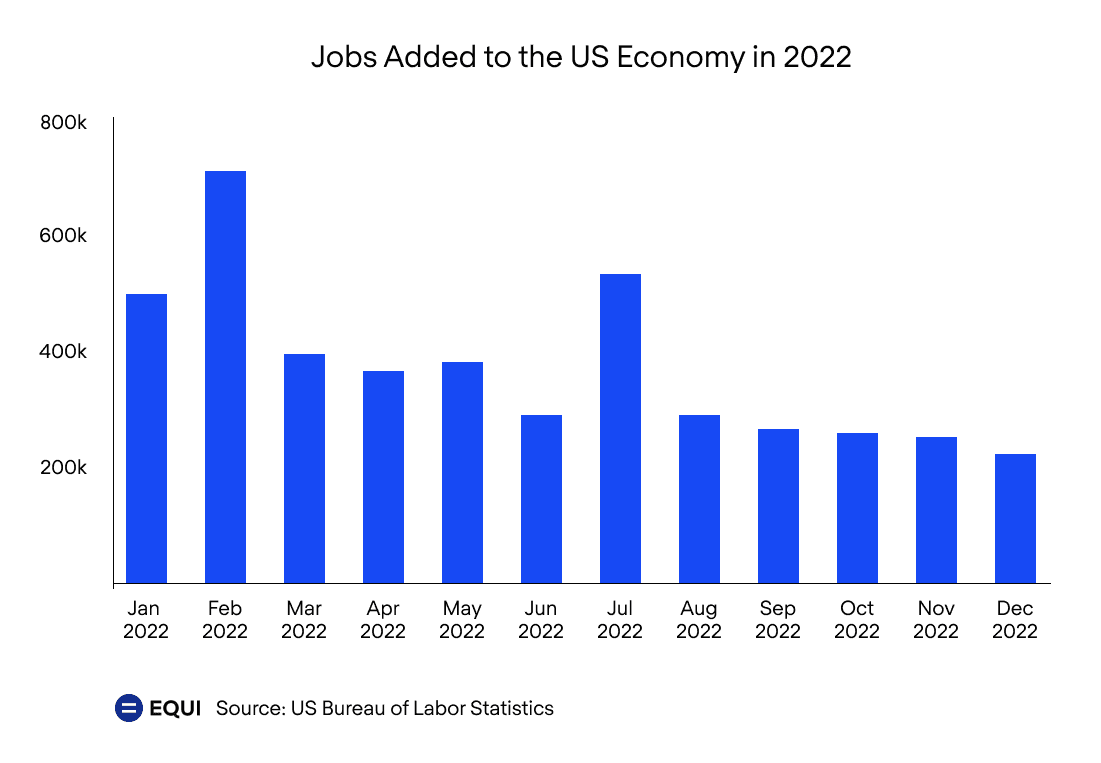

Data Point #3: The Economy Remained Relatively Strong

Despite the concerning statistics we mentioned earlier in this post, the economy remained relatively strong in 2022. For example, consumer spending (adjusted for inflation) remained higher than 2021 levels. Although the tech sector announced massive layoffs, overall employment remained relatively high. The Department of Labor announced that unemployment rate fell to a historically low 3.5% and that 4.5 million jobs had been added in 2022. [Source]

2023 is the Year of the Bear

For the first time in a while, we saw bonds rise as equities were falling. All signs of an impending bear market. The yield curve went back to -50bps from -100bps. These are much stronger signs of a natural bear market than the signs we witnessed in 2022.

So What

If you’re an accredited investor, wealth preservation rather than wealth growth will be the name of the game for the next few years. When you lose 90%, hitting that 10x return investment becomes extremely difficult. Investing into funds that aim to provide wealth preservation through uncorrelated strategies could be beneficial during times of market volatility.