The Diversification Myth

“...increase in rates causes bond prices to decline and may cause stock prices to decline as well…”

-David F. Swensen

For the last few decades, investors were told that they could protect their assets by diversifying across equities and bonds. The logic was that:

1) bond prices typically increase when stock prices fall, thus providing a buffer against stock market volatility

and

2) the coupon payment (i.e. fixed income) portion of bonds could provide a buffer against equity drawdowns.

What investors likely overlooked is the fact that inverse correlation between stocks and bonds is not an absolute truth.

In fact, stocks and bonds are often vulnerable to similar macroeconomic shocks, thus leaving investors vulnerable to the same return drivers or detractors.

Is it rare to see bond and equity prices moving in correlation? Sure. Since 1929, we can only count four instances where bond prices did not increase as stock prices decreased.

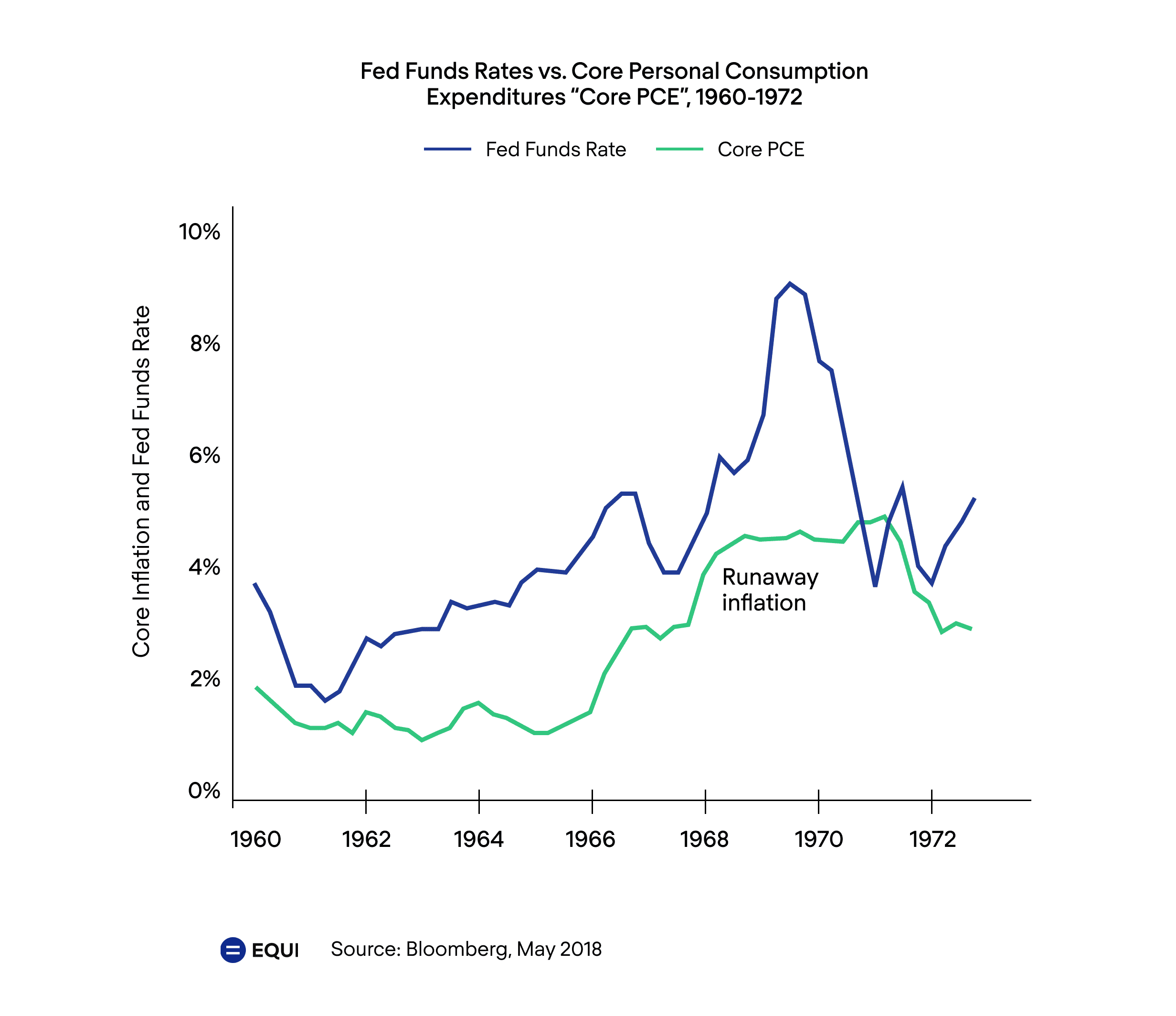

The first was in 1939 when Britain abandoned the gold standard. The second was in 1941 when the United States entered World War II. The third was in 1969 in the midst of what has been called the “the greatest failure of American macroeconomic policy in the postwar period” (Siegel 1994). A combination of loose money supply, perverse monetary policy and two energy shortages led to year over year inflation of over 11% by 1979. Sound familiar?

The most recent example of bond prices plummeting in lock step with the stock market was in 2022.

As of December 30, 2022, CNBC reported:

- S&P 500 at 20% losses

- US Treasury Bond Index at 10.7% losses

- iShares Core US Aggregate Bond ETF at about 15% losses

What this means for the 60-40 portfolio

If stocks and bonds do not provide the diversification touted over the last decade by asset managers, where do investors allocate their capital?

Blackrock provides an analysis on how investors can re-think the traditional 60-40 portfolio with alternative investments as a key driver of true diversification.

Alternative investments whose return drivers are not as vulnerable to macroeconomic factors will likely play an increasingly important role in the portfolio of retail investors.

Questions to consider as you rethink your portfolio

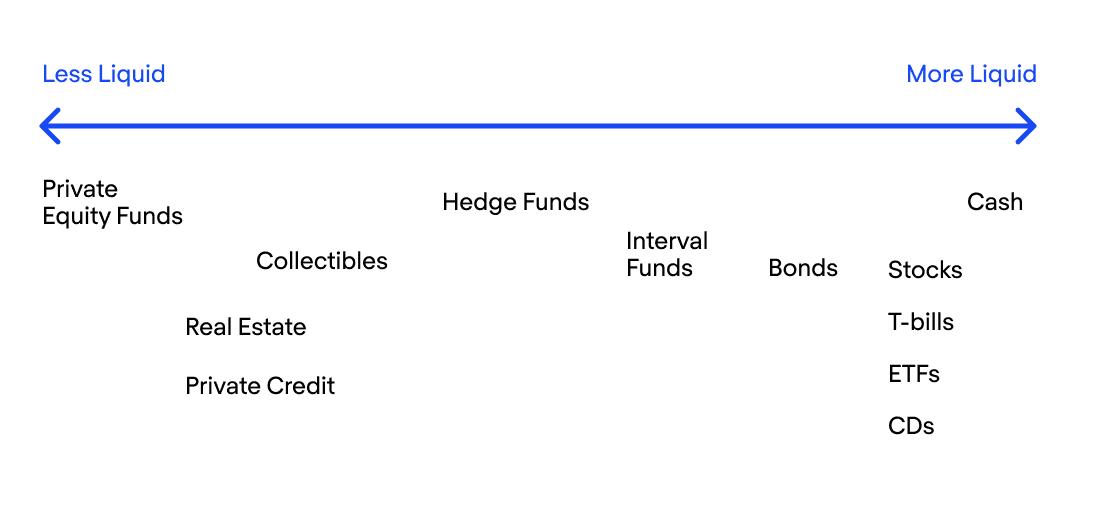

1. What are your liquidity preferences?

Within alternative assets, there is a wide range of liquidity options available. For example, traditional venture capital and private equity firms are quite illiquid and don’t provide a redemption option given the long-dated nature of the strategy. The fund life is typically 12+ years and determined by the fund managers (General Partners) rather than the investors (Limited Partners) themselves. While many PE funds endeavor to distribute investors their cost back (1x distributed paid-in capital, DPI) within 7 years and the remaining profit value before year 12, many of these funds will not fully liquidate for 15+ years. In contrast, hedge funds typically provide quarterly redemptions.

2. How much capital do you have to allocate?

Depending on the amount of capital you have to allocate, the alternative investment options available to you can drastically differ.

For example, minimum initial investment amounts for most hedge funds or private equity firms are usually a few million dollars. Meanwhile, real estate provides a much wider range of upfront capital requirements. Investors can purchase a single family home – whose median price in the United States as of February 2023 was $386,797 – and become a landlord, or they can purchase commercial real estate which can reach hundreds of millions of dollars.

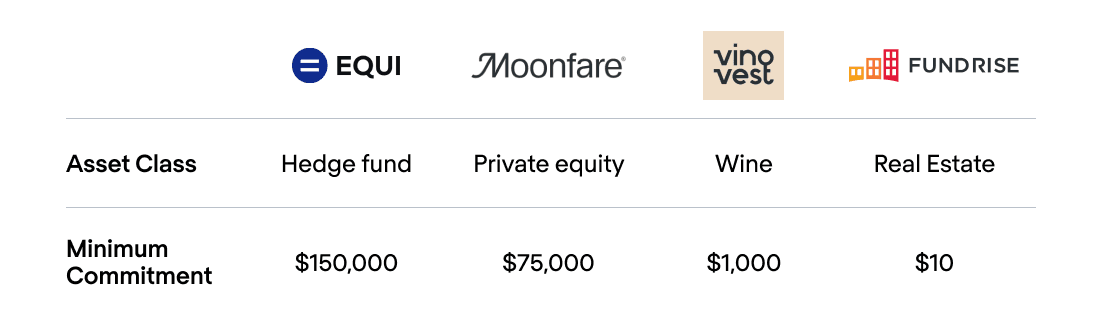

Technology platforms have also increased the number of alternative investment options available to investors, with minimum capital commitments ranging from $10 to $150,000.

3. What are you optimizing for – capital appreciation or income generation?

Depending on whether you’re looking for capital appreciation or a steady stream of income, some alternative investment vehicles may be preferable to others. For example, venture capital or angel investors are generally looking for that one company in a portfolio of dozens that will return 3x the entire fund. However, only about half of VC firms even generate a return for LPs. [Source]

If income generation is your goal, private credit or private real estate could be better options. Private credit could be especially appealing in a rising interest rate economy since many private loans are tied to floating interest rates, providing lenders with a hedge against inflation.

For a mix of capital appreciation and income generation, hedge funds can be an excellent option, with a wide range of strategies that provide various degrees of both. Real estate can also be a good option, providing both capital appreciation and income generation. However, real estate tends to be less liquid than hedge fund investments.