Introducing Equi Dynamic Alpha

Today, we are excited to announce the launch of Equi Dynamic Alpha – a strategy originally launched as part of our Multi-Strategy Portfolio and returned 16.28% net of all fees in 2022.

This strategy is managed by Itay Vinik, Equi’s CIO, and executed by the Equi investment management team.

Fund Characteristics

Equi Dynamic Alpha is an absolute return fund with an emphasis on high convexity opportunities. It is designed for those who favor higher returns despite higher volatility.

-

Target Return = 17%

-

Target Volatility = 12-15%

How It Works

-

A discretionary macro strategy uses a top-down approach that is combined with market microstructure analysis to translate our views into actionable investment ideas.

-

Our dual focus on short-term trade opportunities and long-term macro views allows us to navigate changing market conditions and capitalize on new opportunities.

Why Equi Dynamic Alpha is Unique

A Multi-Timeframe View on Trading

Keen observers of markets will notice that there is a fractal nature to markets. There are certain patterns that are often repeated in the short-term during intra-day trading vs. patterns that are expressed over many months or years. Our team trades across both short and long-term time frames. Core positions are expressed over multi months, while other positions try to take advantage of short-term arbitrage opportunities.

Low Correlation to Equities and Broader Hedge Fund Universe

Low correlation to broader hedge fund universe:

-

0.16 correlation to the HFRI Fund Weighted Composite Index

Low correlation to peers:

-

-0.21 correlation to the HFRI Macro (Total) Index

Low correlation to traditional risk assets:

-

0.31 correlation to the S&P 500 Index

Loss prevention is as much of a priority as alpha generation

We target a daily maximum loss number of around 2% and reduce positions to avoid losses beyond that. Avoiding the geometric nature of losses and leveraging risk-reward models in a meticulous manner allows us to avoid significant drawdowns that often impact macro funds.

The Results Are In

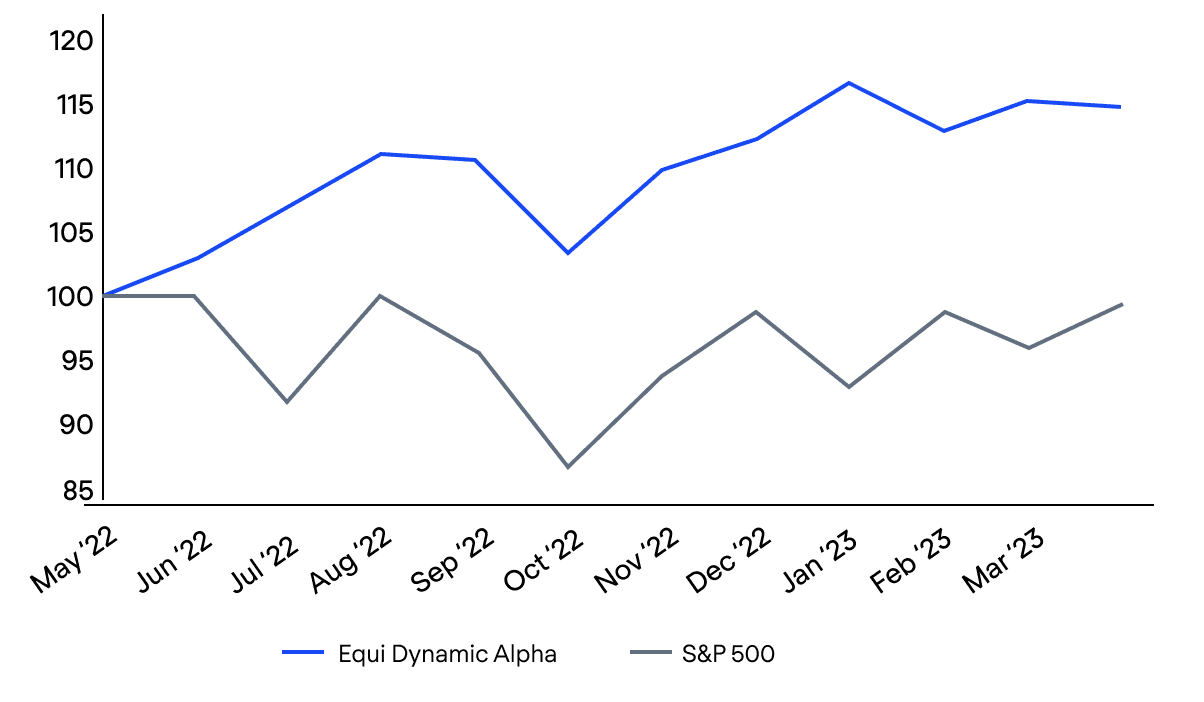

In 2022, we launched Equi Dynamic Alpha as part of our Equi Multi-Strategy Portfolio, which gave us the opportunity to evaluate its performance against 11 external managers that we believed to be some of the best-performing on the market.

The result?

Our proprietary strategy outperformed all other strategies in the multi-strategy portfolio returning 16.28% net of all fees in 2022, and outperformed the S&P 500 by just over 23%.*

Get Access to Equi Dynamic Alpha

Limited Time Founders’ Share Class Seats Available.