Q3 2023 Economic Outlook

If you’re feeling FOMO and itching to get into equities lately, this is the report for you.

A Glance Inside

We make the argument for why positioning defensively for a hard landing may reward the most patient and disciplined investors.

At Equi, our goal over the past 6 months has been to position ourselves defensively to capture potential gains in the event of a hard landing. In addition, we strive to remain truly diversified and uncorrelated to equities so that we can preserve and grow wealth across almost any economic environment. Despite the S&P 500 demonstrating gains that we believe to be the calm before the storm, we remain committed to and confident in our strategy of remaining defensive and diversified. We continue to position ourselves to capture what we believe will be the more significant upside in the long-run.

Here are a few clips from our report:

Our View on What’s Driving the Equities Rally

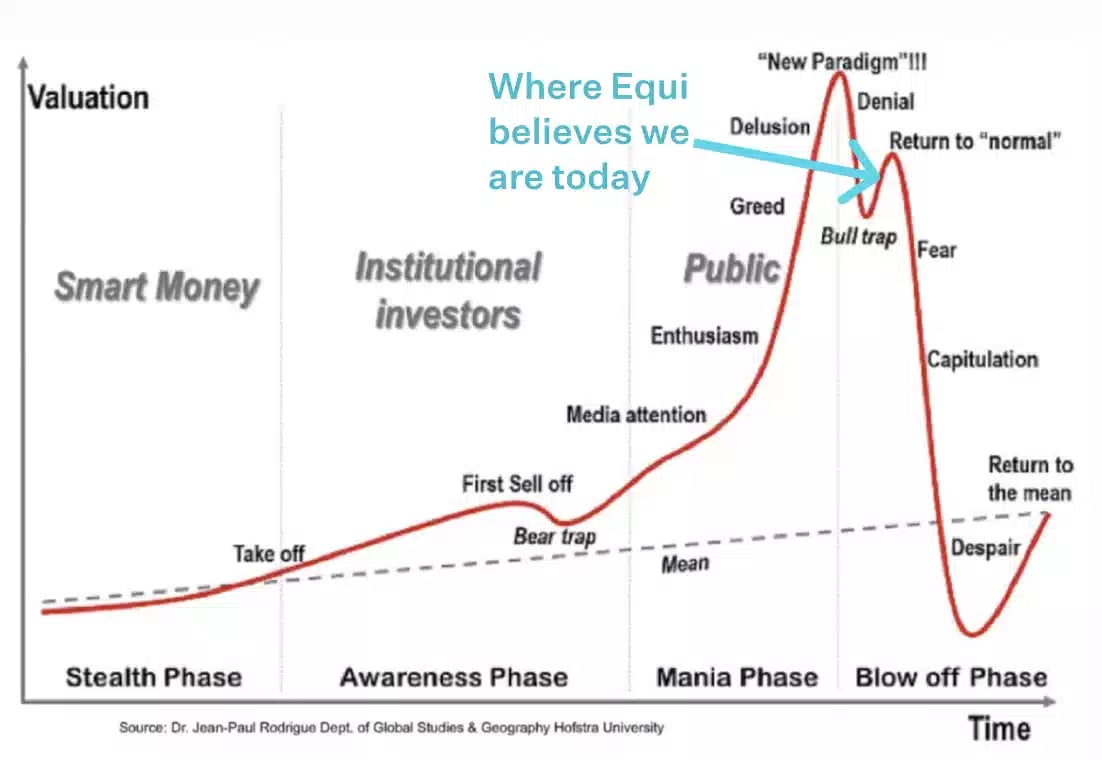

Economic cycles tend to follow the same pattern and we believe that the recent S&P 500 rally is due to what is called a “Return to normal” phase that usually hits before a hard landing. Much of the gains in the S&P 500 are being driven by just a handful of AI stocks.

Why is the NY Fed predicting a recession by July 2024, and are Equi’s macroeconomic models predicting a recession as well?

The NY Fed’s prediction of a recession is consistent with Equi’s proprietary macroeconomic model. The reason for the discrepancy between the media vs. Equi and the NY Fed is the fact that most reports analyze lagging indicators, which point to a soft landing. We believe in placing emphasis on leading indicators (tax receipts, the 2-10 yield curve, the LEI, etc.), which we believe point to an upcoming recession.

How should asset managers position themselves if they anticipate a hard landing?

We believe that asset managers who prioritize trading spreads rather than trading pricing will benefit if there is a hard landing. However, the most challenging aspects of taking a contrarian stance will be patience. Few investors will likely have the patience and the discipline to resist chasing higher pricing that may manifest in the markets short-term.

We encourage you to view our full report to understand what we believe to be the top leading indicators that point to a hard landing.

We remain confident that our patience in this market will result in our continued ability to preserve and grow wealth for our investors.