Real Estate Investing 101: Should I Buy A Home?

Should I buy a home?

While various personal factors, such as financial situation and long-term plans, influence when people decide to buy a house, there are also important economic signals that consumers should consider. Below, we examine a few key economic indicators that we consider to be the most significant when considering a home purchase, and we provide arguments for why 2023 may not be the best time to buy a home.

Housing affordability has decreased significantly

To start, let’s take a look at arguably the most straightforward economic factor that is designed to inform individuals on the affordability of homes.

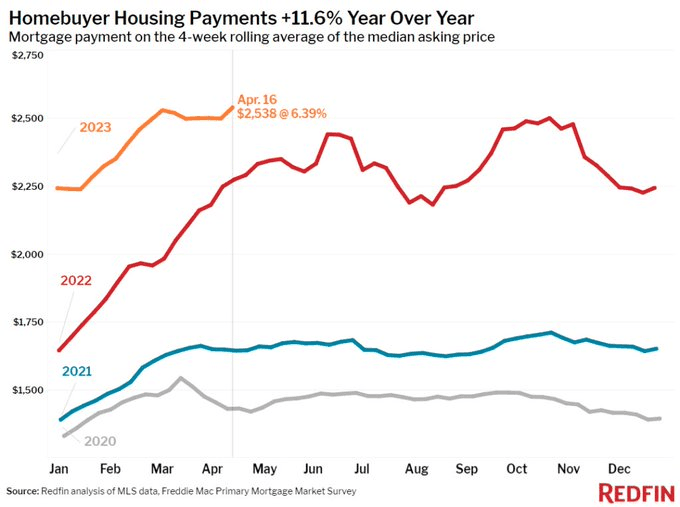

The Housing Affordability Index, or HAI, is calculated by comparing the median household income to the median home price in a particular area and takes into account factors such as interest rates, mortgage payments, and property taxes. Currently, the HAI is hovering at its lowest level since the financial crisis. Why? Although home prices are not skyrocketing month over month, home price affordability is low primarily due to high interest rates.

Goldman Sachs anticipates that Americans will likely not be able to cover new mortgage payment until 2025 or later.

Homebuyers have fewer choices

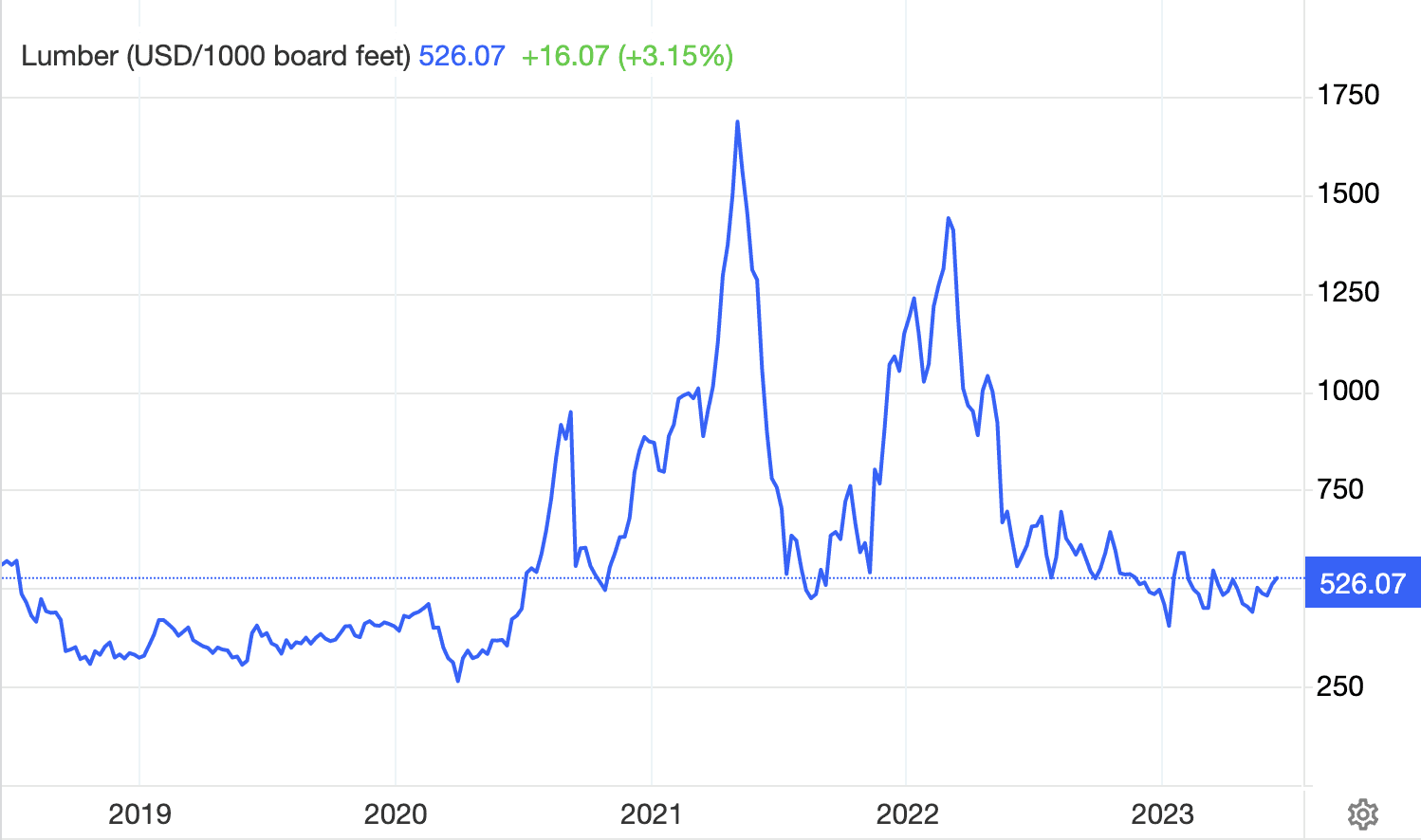

The real estate market likes to keep a close eye on lumber prices. After surging in 2020 and 2021 as people rushed to the suburbs and built or remodeled homes, lumber prices are now down more than 65% from their peak in 2021. This signals that demand has taken a huge hit, meaning the housing market and housing supply is no longer expanding. A contraction in housing supply means that homebuyers are left with fewer choices on the market.

[Source: tradingeconomics.com]

Mortgages will likely be harder to secure

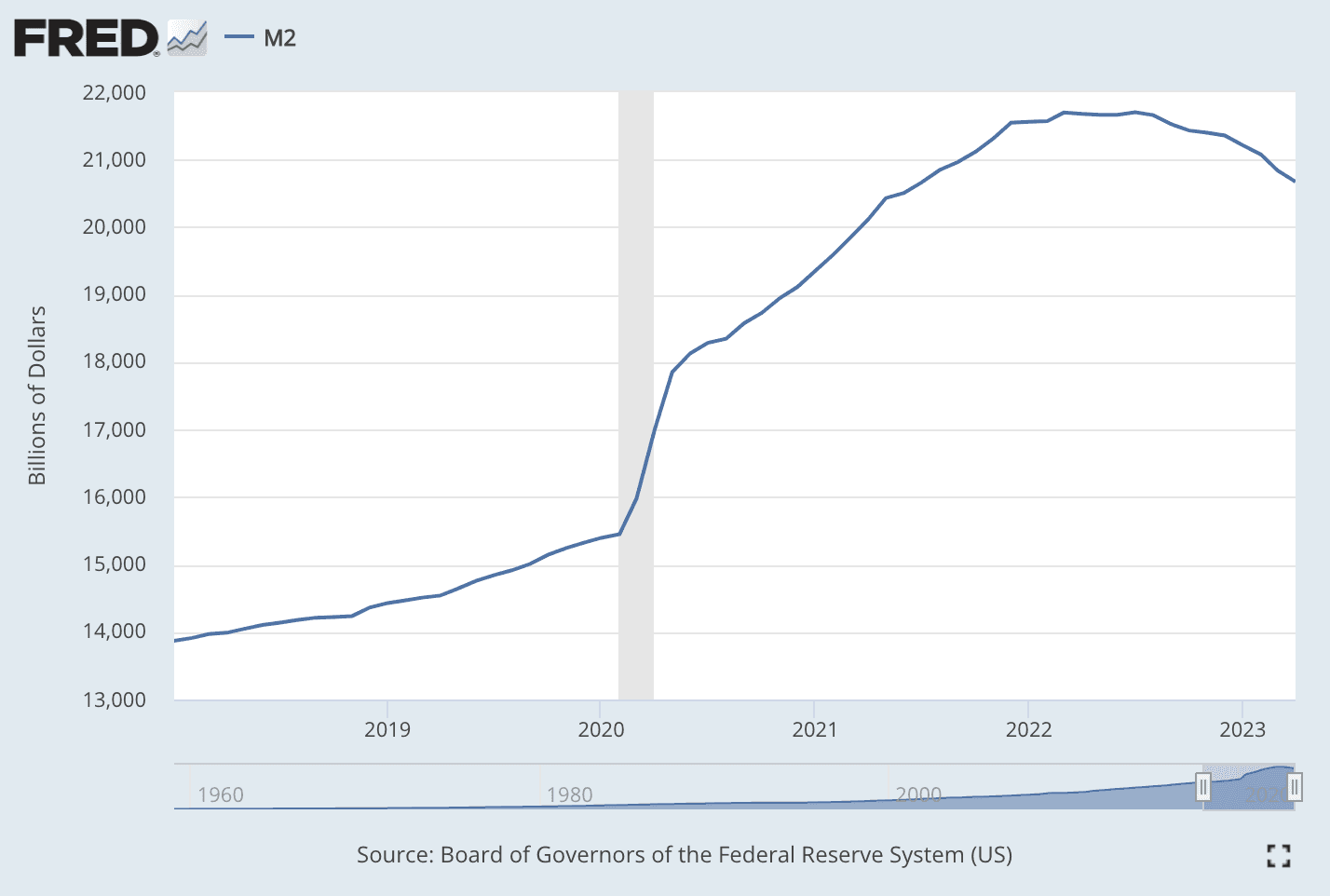

M2 money supply is a measure of the money supply that includes all the components of M1 money supply (cash, checking accounts, and other demand deposits) as well as savings deposits, money market mutual funds, and other time deposits with a maturity of less than one year. An increase in the M2 money supply can lead to increased spending and economic growth, while a decrease in the money supply can help control inflation but may also slow economic activity.

Currently, we are facing the largest deceleration in money supply in recent history. What does this mean for homebuyers? During times of increasing rates and reduced liquidity, banks may tighten credit conditions, making it more difficult for individuals to obtain loans, including mortgages.

Should I Buy or Rent?

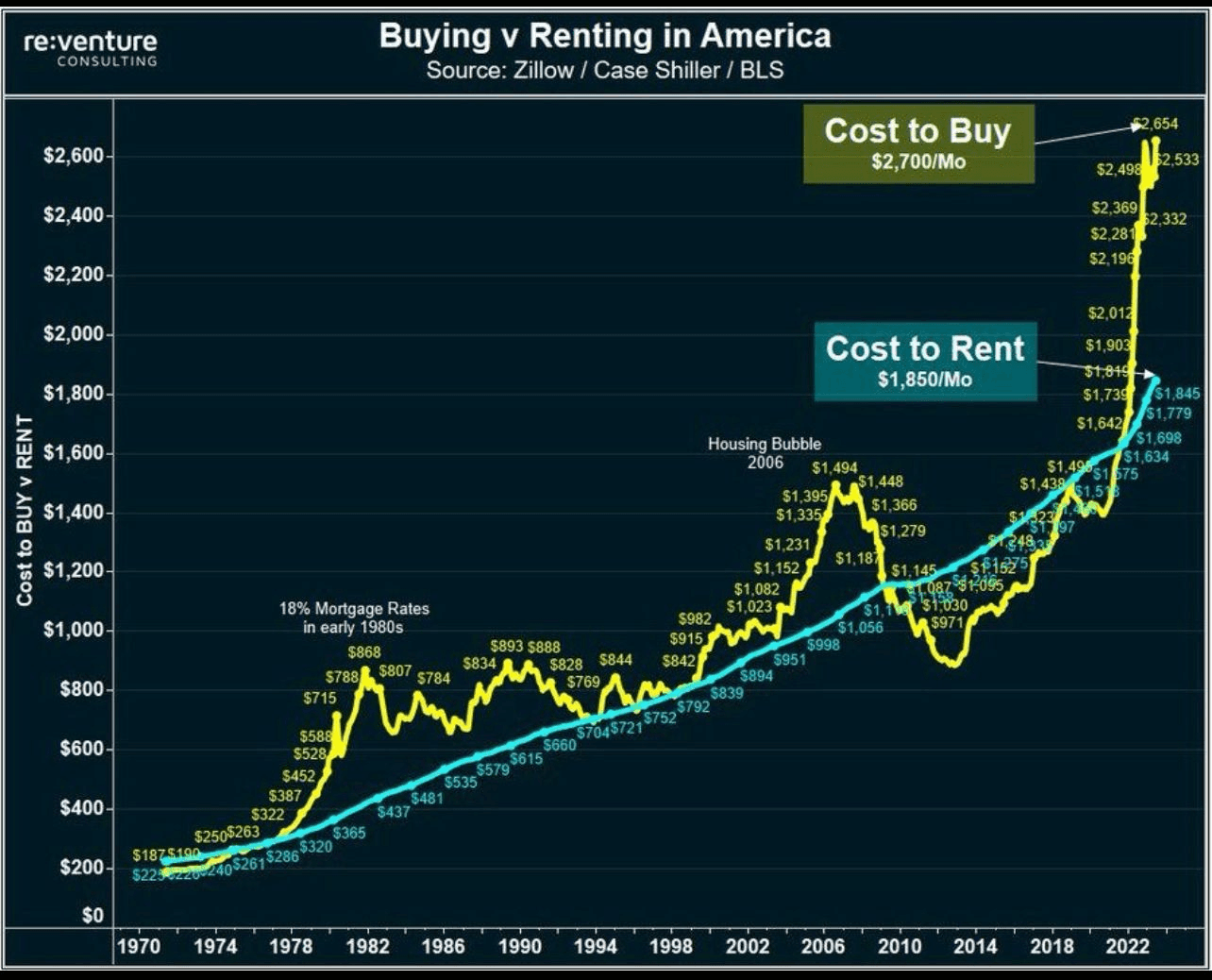

According to Reventure Consulting, the US housing market is in a bubble right now, with the cost to buy rising to $2,700 per month vs. renting at $1,850 per month.

Ultimately, the decision to buy a house is a personal one that depends on your individual circumstances. However, if you’re basing your decision purely on the current economic data, it looks like you’ll be faced with fewer, more expensive choices as housing inventory contracts and mortgage rates increase.